crypto tax calculator uk

The original software debuted in 2014. HMRC has published guidance for people who hold.

Declare Your Bitcoin Cryptocurrency Taxes In Uk Hmrs Koinly

12570 Personal Income Tax Allowance.

. You have investments to make. Since then its developers have been creating native apps for mobile devices and other upgrades. This manual sets out HMRCs view of the appropriate tax treatment of cryptoassets based on the law as it stands on the date of publication.

Crypto CPAs in UK. With over 300000 users CoinTrackinginfo is one of the oldest and most trusted cryptocurrency tax calculators on the market today. It helps you calculate your capital gains using Share Pooling in accordance with HMRCs guidelines.

Sign In with Google. You pay 127 at 10 tax rate for the next 1270 of your capital gains. Heres an example of how to calculate the cost basis of your cryptocurrency.

Or Sign In with Email. Tax on lost or stolen crypto in the UK 11. Crypto capital losses 9.

Ive used Recap for many years Helps me calculate my tax and allows me to focus on trading. Crypto Capital Gains Tax rates UK 6. Income Tax on crypto UK 12.

How to calculate CGT on cryptocurrency UK 7. You pay 1286 at 20 tax rate on the remaining 6430 of your capital gains. Our platform allows you to import transactions from more than 450 exchanges and blockchains today.

The platform is also to start using Koinlys crypto tax calculator. You simply import all your transaction history and export your report. It allows you to calculate the profit and loss from cryptocurrency trading calculate capital gains or losses and take deductions on expenses.

This is because the average purchase price acquisition cost from 20192020 was lower than the purchase price on the date Emma sold 08 BTC. Since Luna is relaunching after having been pulled from exchanges earlier this. You can also generate an Income report that shows your income from Mining Staking Airdrops Forks etc.

This includes popular cryptocurrency exchanges like Coinbase Binance FTX Uniswap and Pancakeswap. Crypto tax in uk 34M views Discover short videos related to crypto tax in uk on TikTok. Your tax authority wants to know your equivalent profits or losses in the local fiat USD GBP AUD or CAD.

Divide the initial investment amount with the amount of crypto purchased lets assume 1000 coins. Coinpanda is the worlds most easy-to-use cryptocurrency portfolio tracker and tax software. Crypto tax breaks.

UK Crypto Tax Calculator. Calculate and report your crypto tax for free now. CryptoTaxCalculator is a software solution designed to automate your crypto tax nightmare saving the pain of manually calculating taxes for each transaction.

In many cases this sort of software also includes a complete crypto portfolio tracker and analysis tool to get a bird eye. How to calculate your UK crypto tax. Choose an exchange.

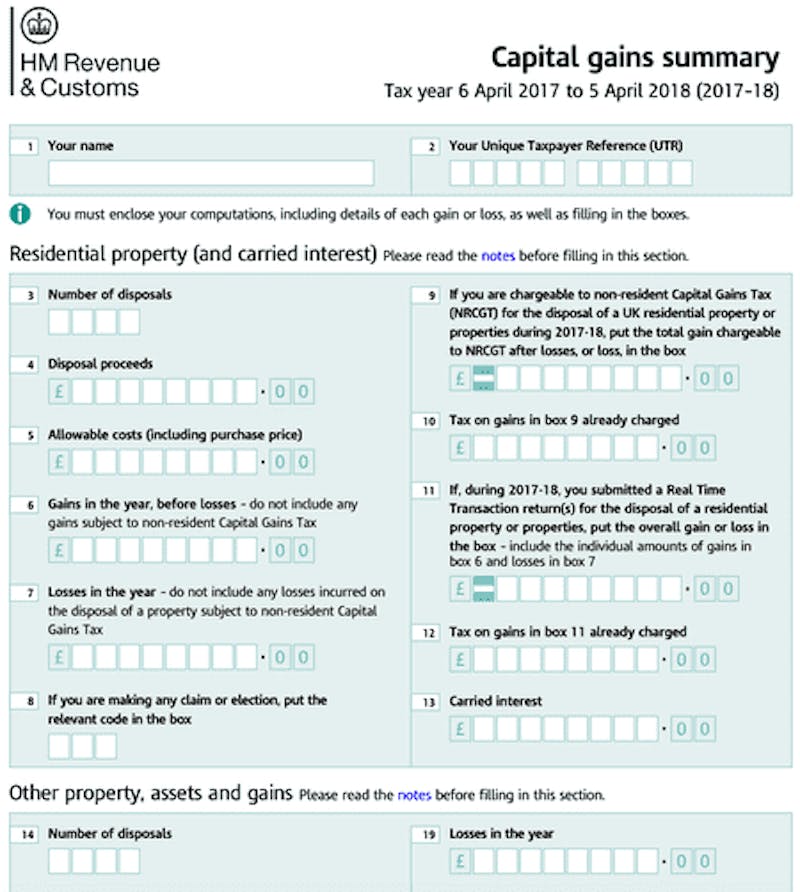

Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports. Calculating cryptocurrency in the UK is fairly difficult due to the unique rules around accounting for capital gains set out by the HMRC. Trading and Property Allowance.

We offer full support in US UK Canada Australia and partial support for every other country. However if the price of bitcoin was lower on this date compared to the average purchase. To calculate your capital gains as an individual the HMRC requires you to keep track of your average cost basis for the token on hand aggregate your same-day transactions and ignore any wash sales.

Stay focused on markets. Watch popular content from the following creators. These guides cover various crypto-specific scenarios.

Full integration with popular exchanges and wallets in Canada with more jurisdictions to come. CoinTrackinginfo - the most popular crypto tax calculator. The only Crypto Tax Software with end-to-end encryption and also the best customer service in the space with specialised crypto accountants working with them.

Youll need to use a crypto exchange to swap your fiat currency pounds sterling for Luna. You can discuss tax scenarios with your accountant. Tax doesnt have to be taxing.

Crypto Capital Gains Tax UK 4. Koinly helps UK citizens calculate their crypto capital gains. Capital gains tax CGT breakdown.

6200 5720 480. Over the last decade cryptoassets have burst on to the investment scene and captured the imagination of investors all over the world. Lets Simplify Cryptorivercrypto Jagjagonline Chris Clarkechrisclarke4 Ryan Kingmakingmoneysimple CryptowithDcryptowithd.

Crypto tax breaks 8. If youve got income from both you can get 2000 tax free. The resulting number is your cost basis 10000 1000 10.

To calculate tax on crypto-to-crypto transactions you have to calculate the value of each crypto in fiat. As with any investment it is subject to tax rules. Crypto tax software is a tool that allows you to prepare your taxes for your cryptocurrency assets.

This means you can get your books up to date yourself allowing you to save significant time and reduce the bill charged by your accountant. EToro - Crypto Tax Calculator. Recap is simply the best Crypto Tax software on the market.

Automated Crypto Trading With Haru. 8 articles in this collection Written by Patrick McGimpsey and Shane Brunette. We can see that Emmas capital gains are in fact lower than Johns.

Koinly is a popular platform with a crypto tax calculator available in over 20 countries including the UK. Straightforward UI which you get your crypto taxes done in seconds at no cost. Let us handle the formalities.

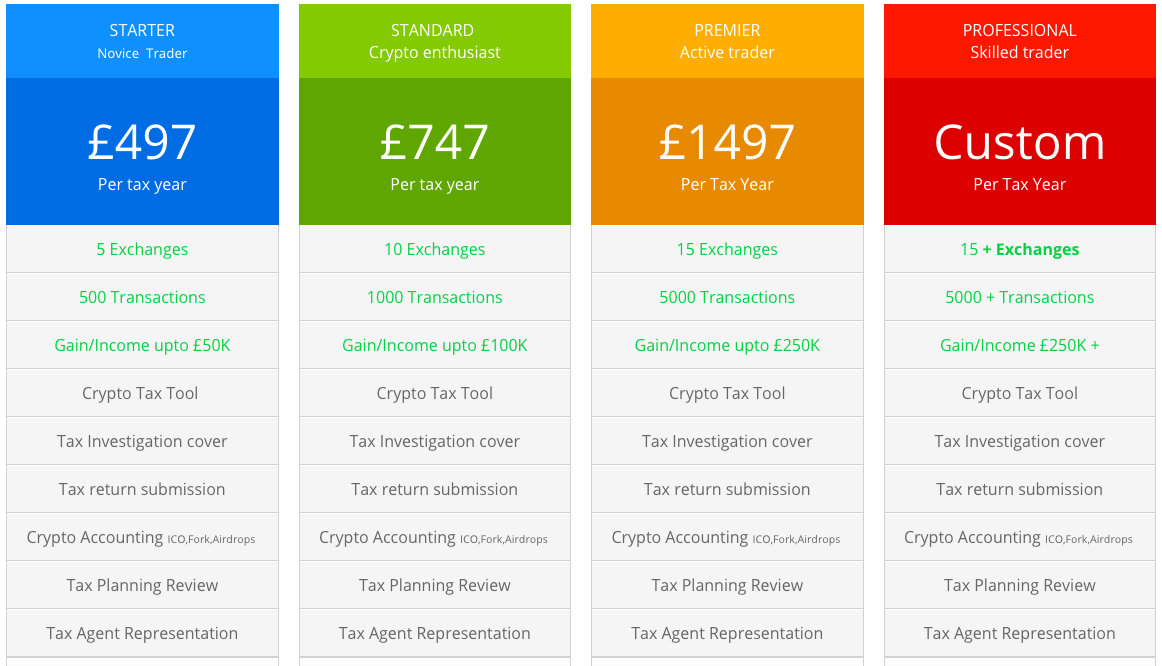

Guides and tips to assist with the generation and submission of reports 1. 1000 of income from trading or property is tax free thanks to the Trading and Property Allowance. We have a list of certified tax accountants in the UK that specialise in cryptocurrencies.

Now that you are clear on how to use our crypto tax calculator and what taxes you will pay on crypto consider how. Tax free crypto UK 10. Take the initial investment amount lets assume it is 1000.

Stop worrying about record keeping filing keeping up to date with. Weve teamed up with Cryptotaxcalculator to facilitate your crypto tax calculation. UK crypto investors can pay less tax on crypto by making the most of tax breaks.

CryptoTaxCalculator performs tax calculations with a high degree of accuracy carefully considering complex tax scenarios. It is the individuals responsibility to calculate any gains or losses through buying and selling. Crypto Tax Calculator Help Center.

Koinly has helped hundreds with their crypto. How much tax will you pay on crypto income. You pay no CGT on the first 12300 that you make.

Do you pay tax on all crypto gains.

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Calculate Your Crypto Taxes With Ease Koinly

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Cryptocurrency Tax Guides Help Koinly

Uk Tax Calc Shop 58 Off Www Tritordeum Com

How To Calculate Cost Basis In Crypto Bitcoin Koinly

Declare Your Bitcoin Cryptocurrency Taxes In Uk Hmrs Koinly

5 Best Crypto Tax Software Accounting Calculators 2022

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Uk Defi Tax On Loans Mining Staking Koinly

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Best Crypto Tax Software Top Solutions For 2022

Capital Gains Tax Calculator Ey Us

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes